When you’re entering into a payment agreement with another person or business, it’s crucial to have a written contract in place. This document details the terms of the agreement and can help prevent misunderstandings or disputes. A payment agreement letter is typically used when one party agrees to make regular payments to another party over a while.

A few key points should be included in the letter if you’re creating a payment agreement. First, you’ll need to state the amount owed and the payment schedule. It’s also essential to have any late fees or interest that will accrue if payments are not made on time. Finally, you’ll want to include information on what will happen if the agreement is breached, such as legal action. You can use the following template when drafting your payment agreement letter.

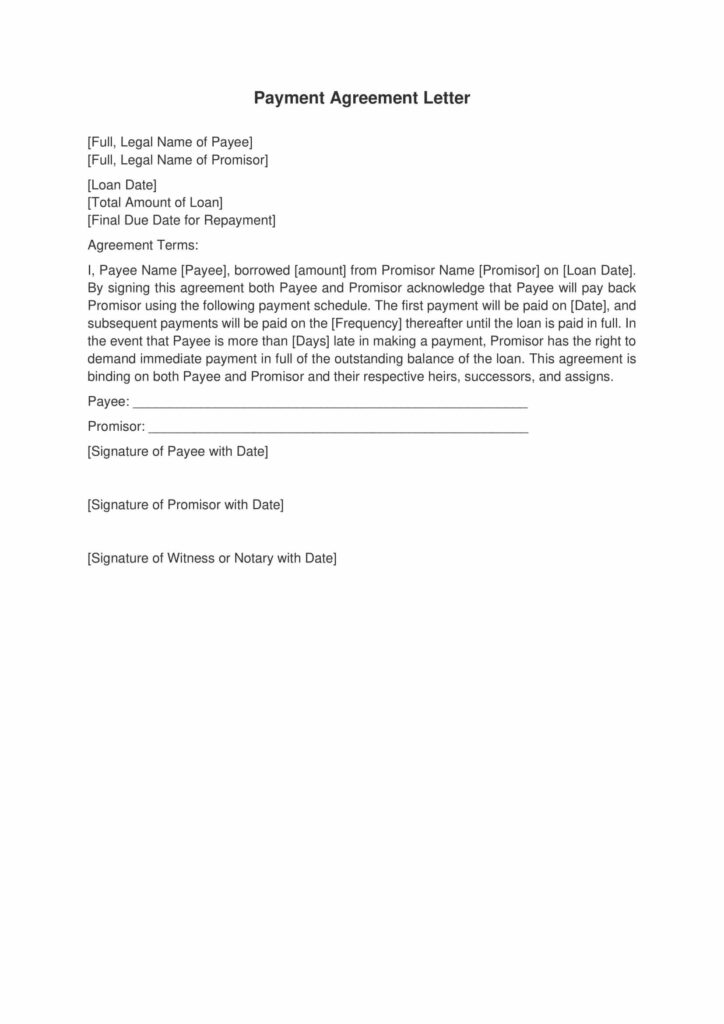

Sample Payment Agreement Letter

[Full, Legal Name of Payee]

[Full, Legal Name of Promisor]

[Loan Date]

[Total Amount of Loan]

[Final Due Date for Repayment]

Agreement Terms:

I, Payee Name [Payee], borrowed [amount] from Promisor Name [Promisor] on [Loan Date]. By signing this contract, both Payee and Promisor admit that Payee will pay back Promisor using the ensuing payment schedule. The first payment will be paid on [Date], and subsequent payments will be paid on the [Frequency] until the loan is paid in full.

If Payee is more than [Days] late in making a payment, Promisor has the right to demand immediate payment in full of the loan’s outstanding balance. This agreement is binding on Payee and Promisor and their respective heirs, successors, and assigns.

Payee: _____________________________________________________

Promisor: ___________________________________________________

[Signature of Payee with Date]

[Signature of Promisor with Date]

[Signature of Witness or Notary with Date]